www tax ny gov enhanced star

Enter the security code displayed below and then select Continue. This application is for owners who had a STAR exemption on the same property in the 20152016 tax year and wish to apply for Enhanced STAR.

The School Tax Relief Star Program Faq Ny State Senate

The following security code is necessary to prevent unauthorized use of this web site.

. Para asistencia en Espaol llame al 516 571-2020. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live with. The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners.

The benefit is estimated to be a 293 tax reduction. The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes. If you are using a screen reading program select listen to have the number announced.

Enter the security code displayed below and then select Continue. Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and. Basic STAR is for homeowners whose total household income is 500000 or less.

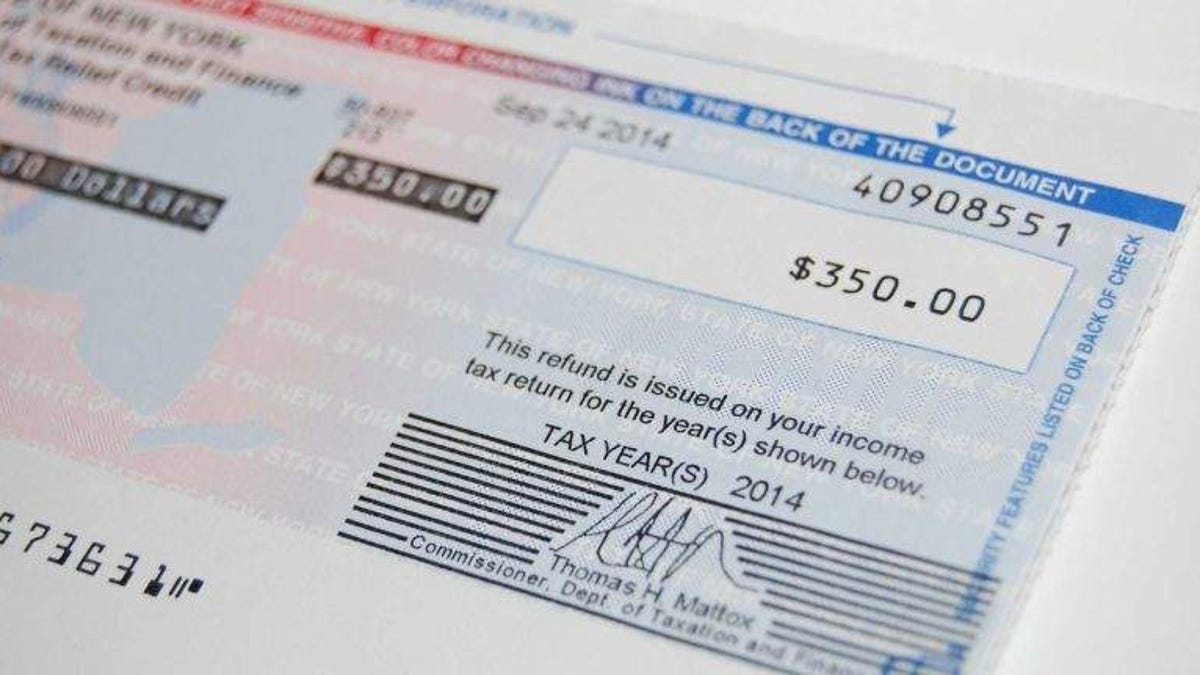

You only need to register once and the Tax Department will send you a STAR credit check each year as long as youre eligible. Homeowners not currently receiving STAR who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance. The following security code is necessary to prevent unauthorized use of this web site.

The STAR program can save homeowners hundreds of dollars each year. STAR lowers property taxes for eligible homeowners who live in New York State school districts. See the STAR resource center to learn more.

If you are interested in filing for the Basic and Enhanced STAR programs please contact the Nassau County Department of Assessment at 516 571-1500. Basic and Enhanced STAR Programs - Tax Assistance. Exemptions that are offered by Nassau County.

If you are using a screen reading program select listen to have the number announced. STAR Check Delivery Schedule. The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older.

Register for the Basic and Enhanced STAR credits.

Tax Exemptions Town Of Oyster Bay

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

Register For The School Tax Relief Star Credit By July 1st Greene Government

Tax Exemptions Town Of Oyster Bay

Village Tax Information Ossining Ny

Online Payment Village Of Phoenix Ny

Enhanced Star Income Verification Program Ivp Enhancement Stars Income

Tax Collector Tax Assessor Town Of Lewis Ny